What next for Apple?

On the negative side, profits were down to $9.5 billion compared to $11.6 billion in Q2 2012. That’s quite a big drop, especially when you look at revenue increasing in the quarter. But what seems to be at play here is the success of the iPad mini. Apple say that the mini makes up the majority of all iPad sales and its margin is far lower than the larger iPad. Apple at present seem to be ok about letting their margins dip while share grows. Apple dominates the “tablet” (iPad) market and they have done this by adding the new mini to grab the smaller device market before a competitor can undermine their position. If we look back, the same happened in the iPod market in the 00s when Apple added the iPod mini, followed by the iPod nano. The smaller form appealed to consumers and it became the biggest selling model.

Good news

The good news is the iPad figure. The continuing dominance of the iPad means that Apple’s is still the default tablet. As home customers and increasingly corporate buyers move away from PCs, the iPad is becoming the device of choice. This combined with the figures for iCloud, where Apple now have 300m accounts, means that iOS is a unique environment. iTunes accounted for $2.4 billion in revenue this quarter from sales of music, apps, films and books etc.

The Mac too is holding its own, especially in turbulent times. Overall PC sales are down about 14% (according to IDC), so Apple’s relatively flat sales are a good result for the quarter. This is especially true when you consider that the iMac was not in full supply until well into the quarter, with supply problems since its December release.

Bad news

The problem for Apple may lie in what comes next. Cook mentioned that new products were coming in the autumn and this may signal a quiet quarter on the hardware front. Apple’s attention seems to now be on WWDC and software announcements, with iOS 7 and OS X 10.9 expected to be key parts of the June event.

iPhone sales will fall away in Q3 just as they always have in the past, in anticipation of the next model being announced. Customers have become very savvy at this and most people will tell you that buying an iPhone in the summer is a bad idea (unless you are being offered a good deal for the soon-to-be-replaced handset).

iPad sales will also be mixed. Speculation about the next model may drive sales down and yet the start of the education buying season, with students returning to school and university, may help balance the figures. However we still expect this to be the lowest quarter of the year for iPad and iPhone, Apple’s two strongest product categories.

Exceptions

Cook referred to new product announcements in the Autumn but there is still the possibility of a new Mac Pro being announced at WWDC. This is the logical place for such a statement. Apple has shied away from hardware at WWDC in recent years, but the Mac Pro is an inexcusable gap in the Apple Mac lineup.

There may also be some refreshing of processors in the laptop lines, possibly to boost the education season. This could wait until the Autumn, but that way all categories may be refreshed in one go, something that Apple may avoid in an attempt to spread out the good news. It’s is also worth noting that any refresh of Macs always happen after any back to education sales offers. This may mean any changes come late in the quarter.

Outlook

Overall we expect Q3 to be about strategy- the next version of iOS and OS X setting the pace for the year. Apple have already indicated that revenue will be between $33.5 and $35.5 billion with a gross margin of 36-37%, lower than in Q2. In Q3 of last year sales were at $35 billion and so ben Apple expect a flat year over year set of results.

However this does all lead us to Q4 and more importantly Q1 2014, where new products come on stream. Q1 is Apple’s Christmas quarter and is always a blow-out set of results and we see no reason why this will not continue. Indeed Cook referred to a new product segment in the conference call and that means one thing- a new leg on the Apple table. Apart from a revised iPhone and iPad, and updated Macs and iPods, it looks certain that they will enter a new market before the end of the calendar year. If investors are looking for signs of growth for the end of 2013 and into 2014, Cook presented them with a perfect hint to what’s next for Apple..

The Facts Behind Reporting of Apple's Q1 Financial Results

- Apple sold 47.8 million iPhones, up from 37 million last year

- It sold 22.9 million iPads, up from 15.4 million

- All based on a Q1 period which was one week less than last year

- iPods were down, but this was well flagged as this market matures

- Mac sales fell from 5.2 million to 4.1, probably the one piece of bad news from the figures. But this was mostly due to Apple not selling the iMac during November. Macs only represent 10% of Apple revenues these days

So where does this leave Apple. Its revenue was a company history, as was its profits, and it is now the most profitable company in history, passing the likes of Exxon. These results were the fourth biggest quarterly profit in history. And there you go- that is what it takes to be doomed in business today.

The Irish Times and the Irish Independent ran the same story written by the Press Association: “Apple figures show stall in growth”. The article accepts that revenue grew 18%, but goes on to say that there is pressure on Tim Cook, Apple’s CEO. We can find no other word to describe this apart from “ludicrous”. Apple has set the bar at the highest level in the last few years and is still breaking records.

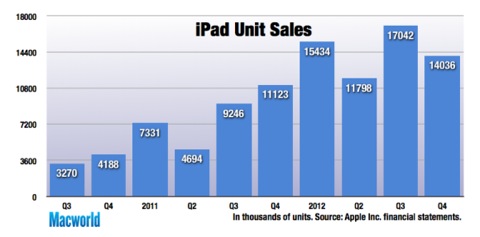

Here, thanks to Dan Frommer at SplatF, are the figures in charts:

The media would need to work had to find bad news in the figures above and yet this is what a section of them have chosen to do. Apple growth year on year is still at 18%, something any IT firm would love to experience right now. Ask Microsoft, RIM, Nokia, Dell or any other firm about Apple’s figures and they would probably sheepishly admit that these are the type of numbers that they dream of hitting. Add to this the fact that Apple is now holding $137 billion in cash reserves, and you see the strength of their position.

In terms of the future, we see that the iPhone and iPad continue to set record sales numbers and we know that Apple is well placed. They have moved from a Mac and iPod manufacturer through to being centred on their iOS devices and this is a transition which Microsoft is struggling to come to terms with right now. As the iPod ages and Mac numbers may be steady, the push ahead is with the iPad as it becomes the number one home (and possibly business) PC. Not only did Apple ride the success of the iPod, but it then stepped off this success and on through with the iPhone, showing how it evolves as a company, knowing where the market is today but ready to move to where the market is heading.

All of the rumours of the decline in demand for the iPhone 5 came to nothing. The iPhone 5 is the most popular iPhone model to date. Demand for the iPhone 4 is also strong and this is Apple cheaper iPhone model. All of the speculation and rumours about Apple introducing a cheaper handset is nonsense. The figures show that the iPhone 4 IS Apple’s cheaper model and the demand for the iPhone 4 and 5 outstrips supply.

At the end of the day the view of analysts needs to be looked at again. Most financial analysts don’t understand Apple or its business model, and the wild expectations for quarterly revenue and growth needs to be reassessed. In recent years Apple have always exceeded their guidance figures for the quarter but the analysts still punish the company when they do not meet the Wall Street expectations, which ride way above the facts and way above the figures Apple had given. They, on occasion, don’t meet the speculative figures given by Wall Street analysts. Analysts punish Apple for not meeting their Wall-Street-created figures. This takes no account of Apple’s reporting, its own numbers, and the facts at hand.

This may be the reason that Apple has decided to change the way it sets guidance figures. In the past it set figures on what it was sure it would meet. They have now said they will set realistic targets, representing what they believe that will achieve, setting the bar that bit higher, and presumably at times they will fall short. We hope that Wall Street have taken note. Apple future guidance numbers may not be met- they are figures that they hope to achieve, but are not 100% certain that they will hit for that quarter. This will open a new chapter in realism but we doubt as to whether Wall Street will take this on board and treat the company fairly in its reporting and speculation..

The Problem with Analysts...

Now all those years later ti would have been a great bet, but it still shows that this would have been nothing to do with any of my skills. It would have been down to two things- Apple’s performance and the whim of the markets.

Which brings us to the latter. In recent months the rumours which have emerged about Apple have swung from the possible (the best you can hope for with a rumour) to the down right ridiculous. Suggestions that Apple absolutely must produce a TV set, have to start selling a cheaper iPhone, need a new Maps and iOS, surely must produce a cheaper Mac, all lead to one conclusion- the majority of analysts know precious little about Apple Inc, its products and its business strategy.

Trading in Apple shares in recent times is a bit like joining a bus load of drunks; it could go well and there could be merit in their behaviour, but the element of unpredictability may lead to disaster. Everyone wants to give directions, everyone thinks thy are right, but you can be sure that fact and considered thought is very, very rare.

Image courtesy of Macworld

And so we approach Apple’s results tomorrow, which will bring another top set of profits and revenues. But this may not be enough for the financial drunks. They need bigger, better, greater and the slightest slip in figures will bring the headlines of doom and disaster. So as a way to see through the fog, here is what we are likely to get from Apple and why, a simple process for people who know Apple and have followed their financial record over the last decade:

iPods: the iPod figures have been declining for some time now. Why? Because the iPhone is part iPod, part phone, part internet device. This means that the iPod is no longer the must have device. Sales are still good, but not as high as they were in the last decade as people now want iPhones and iPads instead. So expect sales to be good, but they will have declined on last year’s numbers.

iPhone: despite all of the nonsense which has been reported about the iPhone in recent weeks such as Apple halving their orders for displays, the iPhone 5 is set to be Apple most successful iPhone yet. It was the biggest seller in the first few weeks of sales, beating the iPhone 4S’ record numbers, and this is likely to continue. The figures tomorrow will though show some differences. For example, Apple could not produce the iPhone 5 fast enough to satisfy demand and so it took a few weeks at the start of the quarter to get phones into the hands of customers. Therefore the inflated guestimates from some analysts may be too high.

Macs: we feel that while laptops sales will be good, the last revision was in the summer, and the only new laptop since then was the new 13” retina display model launched in October. The new iMac was also announced then, but did not ship until December and is still in short supply. Therefore we see Mac numbers falling behind, not because of lack of interest, but due to the iMac not being on sale during November.

iPads: these numbers should be good and it will be interesting to see what Apple say about the mini. It may be that the iPad 4 did not boost the larger iPad numbers as much as it may have if the iPad mini was not launched at the same time. Many people may have bought minis for Christmas instead as they preferred the form factor. But overall iPad numbers should set a new record for Apple.

Let’s then see what happens. The Apple conference call starts tomorrow night at 5pm EST and is available at this address. Just watch out for those analysts on TV and in the press, armed with their drunken numbers.

Apple results due on 24th July

We can also expect news of Mountain Lion, which is due this month and may well be available for download around the time of the results announcement. It is possible that Apple will announce the date of release at the results call.

.

Presswatch: Guardian's take on pay

From the outset, Juliette Garside’s piece is incorrect:

Apple's late founder Steve Jobs created the world's most valuable company and was paid just $5 in the last years of his life – but his successor Tim Cook, unknown outside

Silicon Valley until his elevation to the top job last summer, has been awarded a $378m (£244m) pay jackpot.

A few problems here. Firstly, Steve Jobs did not work for $5. Jobs received a jet from Apple and generous stock options, which had mixed values. Some proved almost worthless due to a fall in the company’s stock value in the mid ‘00s and some made him a lot of money. As for the comment about Tim Cook being unknown outside Silicon Valley, this seems very simplistic. Cook was Apple CEO twice before August 2011, as he stood in for Jobs when he took sick leave. He was well know to any market watchers, and indeed it was Cooks’ reputation on Wall Street which is one of the reasons that Apple now has such a good financial reputation.

However the line that …”Cook's 2011 rewards, disclosed yesterday, put him in pole position to become the year's highest boardroom earner” is simply untrue. The conditions on the stock options, as stated later in the article, only come to fruition in 2016 and 2021. In fact Garside directly contract’s the earlier point, and states that the (UK) FTSE’s average salary for a CEO is now £5.1m sterling, substantially more that Cook’s USD$1m in 2011, even after you add on his bonuses of $0.9m.

The article seems to use Cook as an example, but misses the point. Cook’s stock options, substantial and huge as they are, do not kick in until 2016, when 50% are released, and 2021, when the final 50% are handed over. At that point, who knows what value they will have. Apple is now above Exxon Mobil as the most valuable company in the US, and it can be argued that this is an investment in Apple and Cook. If he stays with Apple, he will become extremely wealthy. If however he leaves, or he fails and the stock price falls, he may find that his options are worth far less than expected. This is what happened to Jobs in 2003 [see here].

Presumably the reason why this substantial stock option was handed to Cook was to tie him to Apple for years to come. This is a good move. We can all argue about the size of this award, but its true value will only be know in 2016 and 2021.

So for the record, for now Cooks compensation stands at under $2m for 2011, split between salary and bonuses..

Apple announce record results: $6 billion profit

Mac sales exceeded 4 million units for the very first time, with strong sales in laptops. Over 16 million iPhones were sold in the quarter, and the iPad also had its best quarter so far, with 7.33 million units.

iPad sales

.

Apple Results: The Headlines

What now for Eric Schmidt?

Schmidt has been a board member at Apple since August 2006. However Apple have said that Schmidt leaves the room during Apple's board meetings when the iPhone is being discussed. Google's own mobile OS, Android, means that Schmidt has excused himself from these discussions to prevent being accused of a conflict of interest. The question now is, will he also have to be outside the room during discussions about the Mac OS, a rival to Chrome OS?

.

.Apple reports record quarter- some notes...

Here are a few points we noted from the financial conference call....

Presswatch: Bloomberg way off the mark...

I found the article distasteful on a number of levels. Firstly it is based on pure speculation; there is currently no evidence to suggest a return of Jobs’ pancreatic cancer, and suggesting this is pure guesswork. .

Steve Jobs issues statement about his health

Today Apple CEO, Steve Jobs, issued an open letter to the Apple community, giving details of his ill-health. It sought to reassure the Apple, and wider business community, of his health position. Jobs has admitted that he is suffering from weight loss brought on by a hormone imbalance, but has aimed to dismiss rumours of a return of his cancer..